Our Trusted AIF & PMS Investment Partners

Invest Now

By submitting the form you authorize AIF & PMS Experts India to call or email you.

Product Categories

We Expertly Choose The Perfect Product For You

Experience a new level of investment confidence with the best PMS & AIF Experts India. Our rigorous process selects the best quality PMS and AIF products along with Gift City Funds customized to your specific financial objectives. By focusing on long-term performance and risk management, we build diversified portfolios that stand the test of time

- AIF

- PMS

- Gift City Funds

Alternative Investment Funds

( AIF )

A pooled investment vehicle that raises money from domestic and foreign experienced investors, according to a specific strategy.

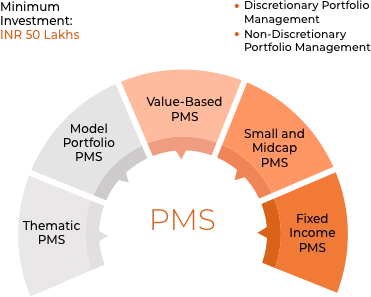

Portfolio Management Services

( PMS )

Customized portfolio management for high-net-worth individuals seeking personalized wealth solutions.

Gift City Funds

( GCF )

Investment vehicles focusing on global markets, providing diversification by investing in foreign equities and assets.

Why AIF-PMS Experts?

Why we stand as the exclusive choice for discerning investors

Choosing AIF-PMS Experts means embracing a proven framework that defies market unpredictability. The bouquets of AIF-PMS funds are tailored for various risk appetites; our unified approach caters to aggressive, moderate, and conservative investors but is driven by one solid process. With belief in our time-tested process, success becomes a shared journey.

350

satisfied investors

500+

Crores invested

10

Countries investors have trusted us

15,000+

investors use our

tools before investing

01

Rigorous Selection Process:

Confident investing starts with our customized 3Is selection process.

02

Consistency

Score:

Experience reliable performance in any market climate.

03

Domain Expertise in AIF & PMS:

Tailored investments for maximum returns.

04

Seamless Digital Investing:

Take control of your investments with real-time insights.

Our Process

How AIF & PMS Experts India Do Things Differently

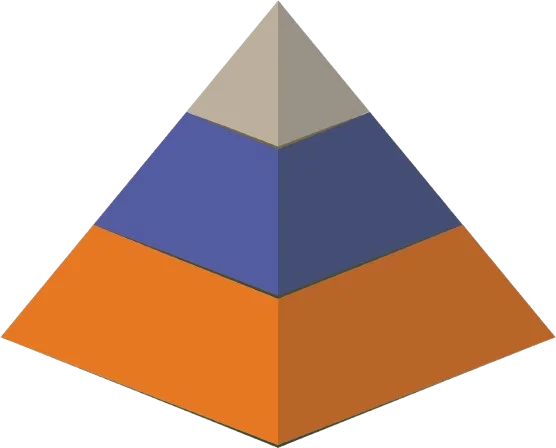

Discover the power of our 3Is investment process. We build robust portfolios by carefully evaluating Investment Manager Style, Investment Portfolio Quality, and Investment Performance Consistency.

The 3I Framework

Investment Manager

Style

Investment Portfolio

Quality

Investment Performance Consistency

-

Investment Style:

Clear, adaptable strategies aligned with investor goals, crucial for navigating market fluctuations and capitalizing on opportunities.

-

Investment Quality:

Focus on strong fundamentals, rigorous risk management, and high-quality assets to ensure stable, long-term returns.

-

Investment Performance:

Emphasizing consistent, risk-adjusted returns, and effective drawdown management to achieve long-term growth while preserving capital.

Testimonials

Hear From Our Investors

Unlike traditional AIF and PMS funds, our proprietary investment process has earned the trust of more than 500 investors. By prioritizing transparency and effectiveness, we've built a strong foundation of confidence.

"I am familiar with Mr. Vikas from his previous job. He loves to read and I was impressed by how he stands by his investing process. I also admire how he always puts his client's goals first."

MR. BIPINCHANDRA DUGAM, Pune

Verified Investor

Verified Investor

"At first, I wasn't sure about working together, but after talking a lot, I saw they have a careful way of picking the best portfolio manager and their plans using something called 3Is."

MS. AVINASH BHANDARI, Ahmedabad

Verified Investor

Verified Investor

"We've been working with Mr. Vikas and his team right from the start. They're really professional and know a lot about what they do. They trust their investing process more than anything else"

MR. MITHUN SUCHAK, Tanzania

Verified Investor

Verified Investor

Unlock Your Investment Potential

It's Time to Boost Your Investing Game

Being the best PMS & AIF platform, we help our investors achieve their financial aspirations through tailored investment strategies. Our expertise in Alternative Investment Funds (AIFs), Portfolio Management Services (PMS), and Gift City Funds ensures that each investment is optimized for growth and stability.

PROBLEM

Frequently Changing Relationship Manager

SOLUTION

Fixed Relationship

Manager

Tired of repeating your investment goals? Enjoy seamless guidance with a dedicated relationship manager who truly understands you.

PROBLEM

Limited Portfolio Manager

Choices

SOLUTION

Availability of Multiple Deserving Portfolio Managers Under One Roof

Don't settle for limited options. Access a diverse pool of expert portfolio managers, ensuring your investment strategy is always optimized.

PROBLEM

Biased Approach

SOLUTION

Data-Driven Unbiased

Allocation

Say goodbye to biased recommendations. Benefit from data-driven decisions for optimal investment allocations.

PROBLEM

Irregular Profit Booking

SOLUTION

Regular Profit Booking

Tired of inconsistent returns? Our strategic profit booking ensures steady

growth.

PROBLEM

Inadequate Servicing

/Updates

SOLUTION

Quarterly Portfolio Review

Left in the dark about your portfolio's performance? We provide thorough portfolio reviews every quarter, keeping you informed and confident in your investments.

PROBLEM

Lack of Market Insightsc

SOLUTION

Direct Fund Manager Interaction for Market Overview

Missing out on crucial market trends? Engage directly with our fund managers for real-time market insights and strategies.

PROBLEM

Limited Investment Opportunities

SOLUTION

Exclusive Opportunities in CAT I and CAT II Investments for

Existing Clients

Feeling restricted by your current options? Enjoy exclusive investment opportunities in CAT I and CAT II funds, specially curated for our valued clients.

PROBLEM

Superficial Research

SOLUTION

In-Depth Institutional Research

Worried about shallow analyses? Benefit from our comprehensive institutional research, ensuring you make well-informed investment choices.

PROBLEM

Generic Investment Plans

SOLUTION

Curated Portfolios to Match Your Investment Goals

Tired of one-size-fits-all solutions? Our portfolios are meticulously curated to align with your specific investment goals and risk appetite.

PROBLEM

Fragmented Portfolio

Analysis

SOLUTION

Comprehensive 360 Portfolio Research

Comprehensive 360 Portfolio Research Frustrated with incomplete portfolio reviews? We offer a holistic 360-degree analysis of your portfolio, ensuring all aspects of your investments are optimized.

PROBLEM

Frequently Changing Relationship Manager

SOLUTION

Fixed Relationship

Manager

Tired of repeating your investment goals? Enjoy seamless guidance with a dedicated relationship manager who truly understands you.

PROBLEM

Limited Portfolio Manager

Choices

SOLUTION

Availability of Multiple Deserving Portfolio Managers Under One Roof

Don't settle for limited options. Access a diverse pool of expert portfolio managers, ensuring your investment strategy is always optimized.

PROBLEM

Biased Approach

SOLUTION

Data-Driven Unbiased

Allocation

Say goodbye to biased recommendations. Benefit from data-driven decisions for optimal investment allocations.

PROBLEM

Irregular Profit Booking

SOLUTION

Regular Profit Booking

Tired of inconsistent returns? Our strategic profit booking ensures steady

growth.

PROBLEM

Inadequate Servicing

/Updates

SOLUTION

Quarterly Portfolio Review

Left in the dark about your portfolio's performance? We provide thorough portfolio reviews every quarter, keeping you informed and confident in your investments.

PROBLEM

Lack of Market Insightsc

SOLUTION

Direct Fund Manager Interaction for Market Overview

Missing out on crucial market trends? Engage directly with our fund managers for real-time market insights and strategies.

PROBLEM

Limited Investment Opportunities

SOLUTION

Exclusive Opportunities in CAT I and CAT II Investments for

Existing Clients

Feeling restricted by your current options? Enjoy exclusive investment opportunities in CAT I and CAT II funds, specially curated for our valued clients.

PROBLEM

Superficial Research

SOLUTION

In-Depth Institutional Research

Worried about shallow analyses? Benefit from our comprehensive institutional research, ensuring you make well-informed investment choices.

PROBLEM

Generic Investment Plans

SOLUTION

Curated Portfolios to Match Your Investment Goals

Tired of one-size-fits-all solutions? Our portfolios are meticulously curated to align with your specific investment goals and risk appetite.

PROBLEM

Fragmented Portfolio

Analysis

SOLUTION

Comprehensive 360 Portfolio Research

Comprehensive 360 Portfolio Research Frustrated with incomplete portfolio reviews? We offer a holistic 360-degree analysis of your portfolio, ensuring all aspects of your investments are optimized.

Investment Potential

Maximize Your Financial Success

Unlock the power of smart investing with diversified strategies. With proven methods that balance risk and reward, you can achieve stability and growth across all market conditions.

Diversify Your Portfolio for

Stability and Growth

Minimize Your Tax

Bill

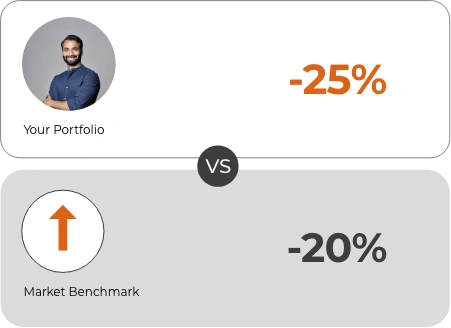

Grow Your Portfolio With

Strategic Insights

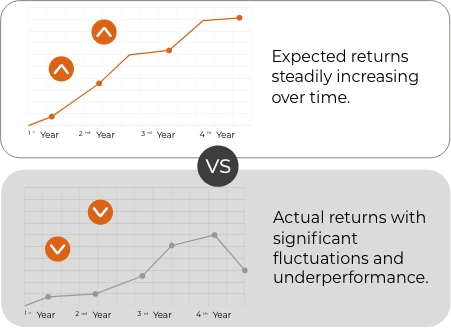

Achieve Consistent

Growth

Maximize Your Returns with Transparency

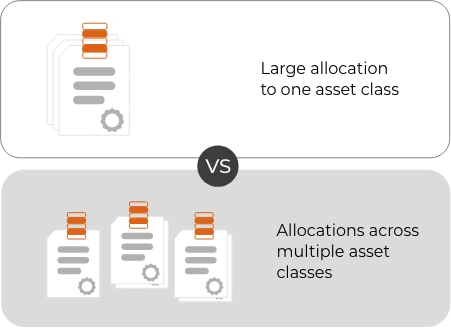

Difference Between AIF,PMS and MF

Find Your Ideal Equity Investment

When you venture into the dynamic realm of equity investments, it's crucial to thoughtfully navigate the diverse avenues at your disposal. This thorough analysis is tailored to unravel the distinctive features of PMS, AIFs, and MFs, providing a guiding light specifically designed for individuals like yourself. Our goal is to empower you with the insights needed for well-informed investment choices, ensuring your journey into the world of equity investments is both enlightening and rewarding.

- AIF

- PMS

- MF

| Suitable | AIFs provide flexibility and diverse investment objectives, making them suitable for those open to longer lock-in periods and seeking a comprehensive investment approach | PMS is designed for those seeking personalized services and substantial returns, making it an ideal choice for discerning high-net-worth individuals. | MFs suit investors desiring risk reduction through pooled investments, prioritizing inclusivity over exclusivity in their approach. |

|---|---|---|---|

| Investment Objective | AIFs offer versatility, addressing various goals like high returns, capital preservation, or diversification | PMS aims at delivering high returns for HNIs and institutions. | MFs, meanwhile, focus on achieving long-term growth and income. |

| Investment Strategy | AIF managers adopt strategies aligned with the fund's objectives | Portfolio managers employ diverse strategies to cater to client's specific needs. | MF managers tailor their approaches to meet the investor's requirements. |

| Minimum Investment Strategy | Rs. 1 Crore | Rs. 50 lacs | Rs. 500 with monthly SIP |

| Fees | AIFs have a 2% management fee and a 20% profit-sharing model | PMS charges 1-3% management fees and profit-sharing fees | MFs follow SEBI-regulated expense ratios ranging from 1% to 2.25% |

| Liquidity | AIFs may have lock-in periods and limited liquidity options | PMS provides direct ownership with relatively less liquidity. | MFs offer high liquidity. |

| AIF | PMS | MF |

Top Performing AIF-PMS Funds

Your Goals, Our Curated Funds

As the best PMS AIF Service Provider in India, we streamline the process by carefully selecting top-performing funds that align with your investment objectives. Our proficient team diligently analyzes thousands of options to curate a portfolio of exceptional products, saving you time and effort.

AIF and PMS Frequently Asked Questions

Got Questions About AIF and PMS?

Explore our FAQ section to find answers to the most common queries investors have about Portfolio Management Services and Alternative Investment Funds.

- AIF

- PMS

-

What are AIF Funds?

Alternative Investment Funds (AIFs) are privately pooled investment vehicles established in India, designed to collect funds from specific investors according to a predefined investment policy.

-

Who can invest in AIF?

All Indians, including NRIs, PIOs, and OCIs, can invest in AIFs, provided they meet qualifying requirements such as a minimum capital of Rs20 crore for each program. Investors must make a minimum investment of Rs1 crore or Rs25 lakh in the case of AIF employees, directors, and fund managers.

-

How can I invest in AIF?

Risk-taking investors desiring diversification can invest in SEBI-registered AIFs. Joining our platform will guide you through the entire investment process, ensuring a seamless experience.

-

Can AIF give Loans?

AIFs are privately pooled investment vehicles where funds are not used to give loans, distinguishing them from traditional lending structures.

-

Are AIFs high risk?

AIFs carry higher volatility and risk compared to traditional assets like equities and bonds. Their complexity and limited liquidity contribute to their unique risk profile.

-

What is PMS?

Portfolio Management Services (PMS) is an investment service tailored for high-net-worth individuals (HNIs), offering a professionally managed portfolio consisting of stocks, fixed income, debt, cash, and structured products. With PMS, you own individual securities, providing the freedom to customize your portfolio according to your specific needs and objectives.

-

Is PMS better than mutual funds?

Professional fund managers in PMS have historically generated better returns than direct equities and mutual funds over longer tenures.

-

How is PMS taxed?

A PMS investor's tax burden aligns with direct capital market access. Consultation with a tax expert is advised, and at the end of the financial year, the Portfolio Manager issues an audited statement to assist in determining tax responsibilities.

-

Who is a Portfolio Manager?

A portfolio manager is a professional responsible for making investment decisions, managing portfolios, and trading on behalf of individuals or institutions.

-

What is PMS in banking?

PMS or Portfolio Management Service, is a professional service where qualified portfolio managers manage equity portfolios on behalf of clients, providing a personalized approach.

Wisdom Hub

Wisdom Hub is Your Go-to Resource

Unsure about PMS and AIF? Our FAQ section covers the most common questions investors like you have.

- BLOGS

- VIDEOS

- PODCASTS

Explore in-depth videos and insights to better understand equity market trends and investment strategies. Gain valuable perspectives from industry experts to enhance your portfolio performance.

Stay updated with the latest market trends, strategies, and financial advice from industry experts through our insightful podcasts. Listen anytime, anywhere for actionable insights.

Book A Meeting

Book A Meeting +91 95616 10108

+91 95616 10108 WhatsApp Us

WhatsApp Us